Florida 1031 Exchange

A 1031 exchange, commonly referred to as a like-kind exchange, allows investors and developers to defer capital gains taxes on the sale of investment property by reinvesting the proceeds into a similar property. More specifically, a 1031 exchange is a tax-advantaged tool to swap one investment property for another, thereby allowing the seller to defer any tax liability until the replacement property is eventually sold.

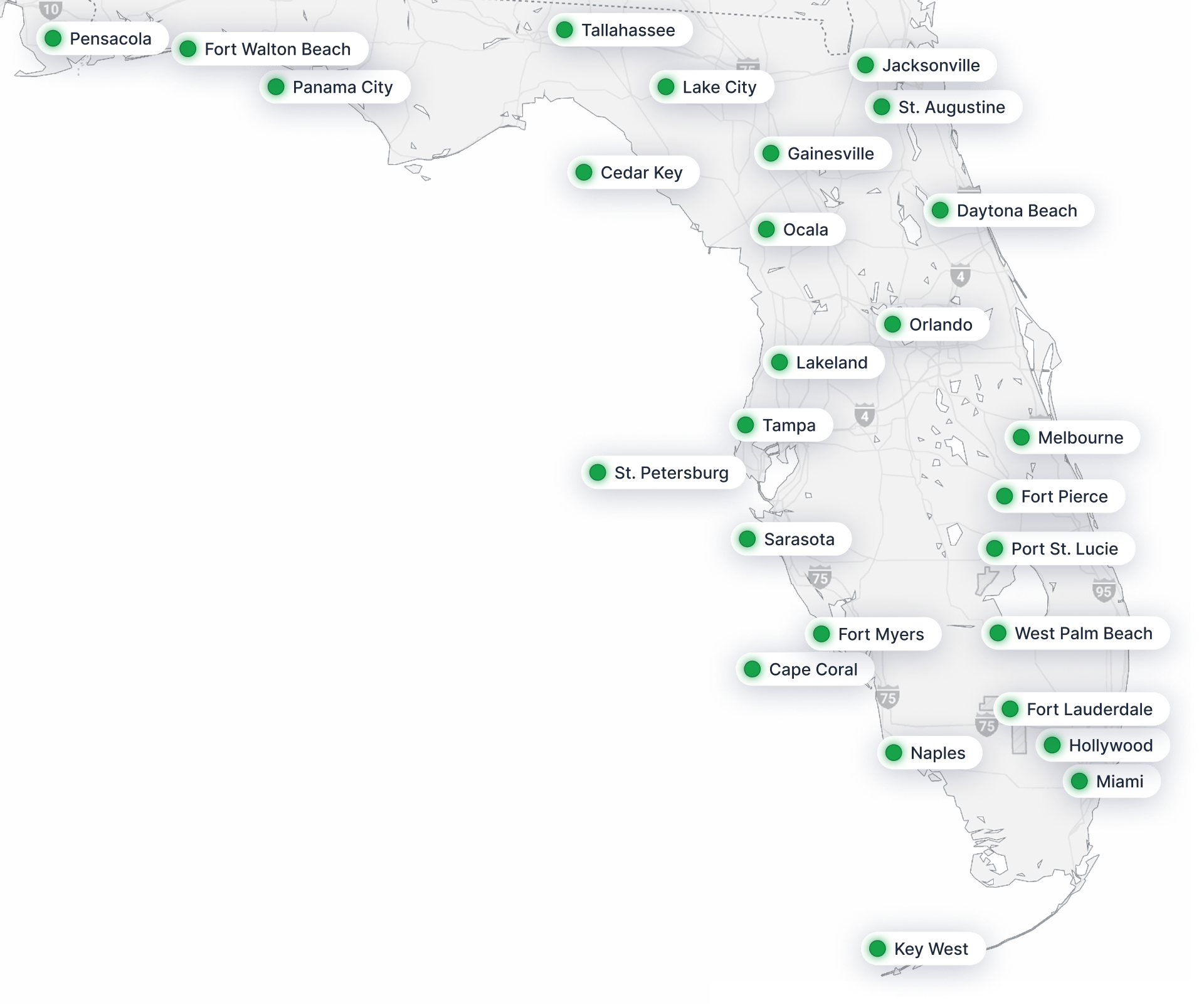

Fifty Stars Title and Escrow LLC has the expertise to facilitate the completion of a like-kind exchange in a manner compliant with Section 1031 of the United States Internal Revenue Code.

So that we may further assist you, please call or email Michael Roussis at (305) 209-4380 or mroussis@fiftystarstitle.com

Michael Roussis

Licensed attorney* & real estate broker

Contact Us

Navigation

Who We Serve

Services

© Fifty Stars Title and Escrow LLC 2026